By Johan Burgren, business manager Marine, PowerCell

To date, the International Maritime Organization (IMO) has focused many of its greenhouse gas (GHG) regulations on bigger ships in the merchant fleet that make up 85% of the industry’s carbon footprint. But it is the other 15% – such as short-sea fixed route shipping – where ultra-low- and zero-emission technology is ready to be adopted today. It is only a matter of time before the IMO turns its attention to these quick wins, as many other stakeholders across the global trade value chain are already doing.

Starting in January 2024, CO2 emissions from ships above 5,000gt and transporting cargo or passengers for commercial purposes will be included in the European Union Emissions Trading System (EU ETS). Emitters will have to exchange emissions allowances, incurring additional costs. Initially, 40% of emissions are in scope, but this will quickly ramp up to 70% for 2025 and to 100% for 2026 onwards. The cost of carbon is rapidly becoming significant, and as polluting becomes more costly, the payback period for zero-emission technology will shorten.

The IMO’s Carbon Intensity Indicator (CII) rating system is also set to become more relevant. A CII rating is a measure of how efficiently all ships transport cargo and passengers measured in grams of CO2 emitted per deadweight ton capacity and nautical mile. While many see CII as less impactful in its current state, the IMO is currently iterating upon and improving the regulations. The regulations and thresholds for superior ratings tighten over time, but zero-emission technology offers futureproof long-term compliance.

Class society DNV’s analysis of EU MRV data revealed that a significant portion of the existing ro-pax fleet will already have challenges meeting CII requirements within the next two to five years – 47% with CII ratings of D and E. This is not just the case for old ships, but also vessels 10 years of age already rated E. While non-compliance can be fairly straightforward to mitigate, the real risk of an inferior CII rating is commercial.

Picture this: it’s 2035, and the expectations of revenue-generating passengers and cargo owners in the ro-pax market have changed dramatically. As cars and haulage become predominately electric in the near future – will motorists, cargo owners and regulators really accept a CO2-spewing ro-pax ship? It is realistic to predict that a superior CII rating of A or B will become a licence to operate in some markets and for the best cargo owners.

Ultimately, a combination of customer pressure and increasingly comprehensive regulations will drive the ro-pax market to decarbonise. Paying a high cost on carbon or receiving an inferior CII rating is sure to impact earning capacity, reputation and, by default, asset values – posing a balance sheet risk. From a financing, commercial and regulatory standpoint, it is key to invest in sustainability now to remain competitive.

Futureproof energy transition planning

The European ro-pax fleet is currently an average of 38 years old, according to PowerCell’s analysis. This age profile means that there is a significant need for newbuilds or to retrofit the existing fleet. Companies need capital for both of these endeavours, and fleets with strong sustainability credentials will be better placed to secure financing.

Receiving superior Poseidon Principles-aligned green financing will rely on shipowners and operators providing a viable plan for a 30-year lifespan; but not all solutions are viable in the long run. The risk of investing in assets that become stranded is real. A drop-in fuel, for example, will not be for life, is costly, and will require a plan for ultra-low/zero-carbon alternatives in the future. Effective planning for the energy transition must be long-term and solutions should be futureproof.

A tangible example

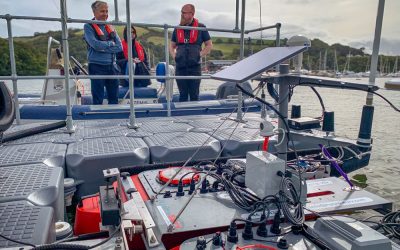

PowerCell’s recent agreement with Norwegian transport group Torghatten Nord is the culmination of three years of planning for the energy transition. It is delivering hydrogen fuel cells to two 120m, 599-passenger capacity ro-pax ferries, each carrying 120 cars and 12 trucks. These will be Norway’s first full-scale hydrogen-powered ferries.

The ferries will be powered by green hydrogen, and the fuel cells are expected to reduce their combined CO2 emissions by 26,500tonnes per year, which corresponds to the CO2 emissions from 13,000 diesel cars per year being removed from the roads. Green hydrogen supply infrastructure developer GreenH AS has agreed to provide renewable hydrogen for the ferries from 2025 to 2040.

Fuel cells will also enable the vessels, which will operate on Norway’s longest ferry route (a four hour journey, with challenging weather conditions) to produce approximately 6MW of power each. The order has a value of €19.2 million – representing the largest non-combustion fuel propulsion project to date in the global marine industry.

These are not concept designs or demonstrator vessels, they are real ships using hydrogen fuel cells. They are scheduled to operate from October 2025 as part of a replacement programme for similarly sized and operated fossil-powered ferries. This is a statement project that highlights hydrogen fuel cell-powered ferries have now become a realistic option that shipowners worldwide can invest in, and that green hydrogen is increasingly available.

Ships with fixed routes and frequent port calls are a clear place to start as they can really benefit from alternative fuels. A ro-pax needs power from A to B, not for two weeks at a time or longer. This is where the use of fuel cells comes into play as they are perfectly suited for demanding applications where operational reliability, high power density and compact format are important parameters. They also deliver a particularly strong return on investment on these routes.

This project, financed by Statens vegvesen (the Norwegian Public Roads Administration), clearly demonstrates that fuel cells are primed to tackle a major source of transport emissions. Beyond regulations, the right financial support from the government certainly helps. Norway is already showing the way for others to follow. The Torghatten Nord project forms part of a Norwegian government initiative that aims to see all ferries crossing the Vestfjorden between Lofoten and Bodø in Northern Norway be emission-free. This is a ground-breaking project for Norway and the marine industry as the country is taking an important step to establish green hydrogen as a clean energy source.

In summary, demands for zero-emission marine transport from customers, regulators and financiers are increasingly strong and only set to strengthen in the future. Ro-pax shipowners and operators must plan for this reality and the longer-term energy transition, and adopting futureproof zero-emissions technology should be central to any sustainability strategy.

The fact that fuel cells can meet the needs of such a long distance route in Norway – and one with challenging weather conditions – shows that a new generation of technology is here. Fuel cells are ready to take on the heavy lifting of marine decarbonisation and there are opportunities to use them. In Norway alone, there are roughly 800 ferry lines and ferries are a segment where we can expect great interest in hydrogen-electric solutions.

Johan Burgren, Business Manager Marine, PowerCell Group

RINA’s technical conference ‘Managing CII & Associated Risks’, taking place at IMO Headquarters on 16-17 January 2024, will feature a range of insights on perspectives on the impact of the Carbon Intensity Indicator. See here for more information.