With nearly a third of the current feeder vessel fleet over 15 years old, and a quarter in excess of 20 years, newbuild contracting by owners will have to increase in the coming years to replace ageing vessels as progressively tighter environmental regulations come into force. However, the huge amount of uncertainty surrounding emissions reduction and the expected transition to zero-carbon fuels is making it difficult for investors to decide how best to spend their money.

It’s a complex riddle, notes Oskar Levander, Kongsberg Maritime’s senior vice president of business concepts. “There’s no silver bullet new fuel, and there’s no one-size-fits-all approach or clear timeframe,” he tells The Naval Architect. “This brings uncertainty for the shipowner. And if there’s one thing that shipowners don’t like, it’s uncertainty. It would be much easier to have everything prescribed… this stage shift to this stage shift… but that isn’t there.”

Levander adds that Kongsberg Maritime has been working on ways to meet the coming needs of the feeder shipping sector for some time, combining existing and new technologies with digital solutions to propose a design for a feeder vessel that shipowners can order today “secure in the knowledge that their investment will still be competitive and relevant for years to come”.

The new 2,000TEU Kielmax concept, designed in partnership with Deltamarin and known as Cobalt Blue, features a range of innovative features for the container feeder market, at the heart of which is a modular design that will permit the vessel to be upgraded over time to transition through fuel types during the working life of the ship. The core aim is to offer shipowners a future-proof vessel that delivers efficiencies and sustainability benefits now, while preparing the sector for future developments such as the need to switch to alternative fuels to meet tighter emission requirements.

Last month the design received approval in principle from classification society DNV. “This independent assessment of our design concept has confirmed that the Cobalt Blue, with all its innovative features, is a feasible proposition with no major obstacles to enable it becoming reality,” Levander says.

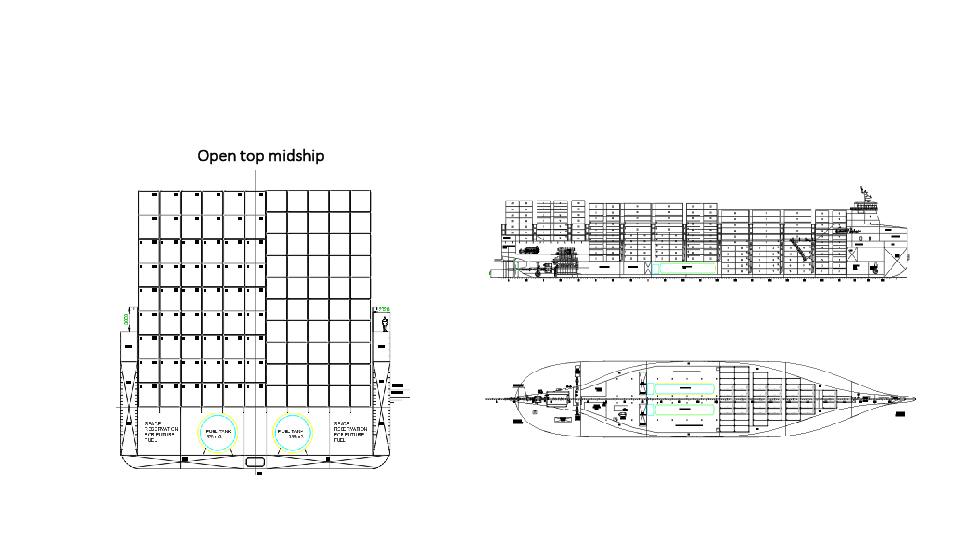

The open-top design enables space reservation for alternative fuels. Source: Kongsberg Maritime

Open-top deck

One fundamental element of the design is an open-top deck, eliminating the need for heavy cargo hatches. “It’s not a new thing, but it’s not common on container ships and we think the open-top is the right approach for this size a vessel, taking into account the future-proof requirement,” explains Levander.

He adds: “It’s this feature that provides the flexibility for any future installations requiring extra space, such as battery containers or additional tanks for alternative fuels. By lifting the cargo up, these can be located below the container stacks without losing valuable cargo space, which wouldn’t be the case on vessels with hatches.”

Any stability issues caused by raising the cargo height are addressed by the vessel’s increased beam, which is slightly wider than a typical vessel of this size but still allows the ship to navigate the Kiel Canal. Stability can be further enhanced with Kongsberg Maritime’s optional container loss safety system, which combines active stabilisers with intelligent weather routing and steering to minimise the risk of cargo loss.

A forward deckhouse will help protect the cargo against green water coming into the ship, with tarpaulins to provide further protection for the containers, which slot between tall cell guides. “These partitions are watertight below the main deck and mesh above,” says Levander. “The cell guides will speed up the loading and unloading process, because the containers don’t need to be lashed so much – on more conventional ships, they’d normally need to be tied down to each other.”

Time is also saved by not having to open and close hatch covers, Lavender adds. “By making vessels which are efficient at port operations, we can facilitate fast turnarounds with fewer crew members,” he says.

Perhaps the most pressing dilemma for shipowners is fuel choice. Kongsberg’s approach is to start with LNG, which, according to Levander, gives a solid basis for conversion to most of the alternative future fuels currently being suggested. “There is already an infrastructure for LNG… we can use it now,” he explains. “In time, shipowners can easily switch to liquid biogas or synthetic LNG, using the same engine whenever that fuel becomes available at an attractive cost, because it’s essentially the same fuel. Basically, LNG is methane, biogas is methane and synthetic LNG is methane: it’s the same molecule, it’s just produced in different ways.

“In addition, through using dual-fuel engines, vessels can also operate on diesel or renewable options such as HVO. Operation with ammonia will be possible via a conversion, which we will make as simple and cost-effective as possible. With multiple current and potential future fuels applicable to their vessels, shipowners can be confident they are safeguarded and ready for the next steps.”

Fuel storage

Fuel storage is one of the most likely areas to demand significant change to the vessel, especially for high-volume fuels such as ammonia. The two pre-installed C-type LNG tanks onboard Cobalt Blue – giving a range of around 3,000nm – have been designed to be ammonia-ready, and the vessel’s open-top, modular design makes installing further storage fairly straight forward with the option to add extra tanks below the cargo.

Machinery wise, the 183m vessel comes with a two-stroke MAN 6G60MEC10.5-GI+HPSCR dual-fuel engine, two DF gensets, one diesel genset and a hybrid shaft generator that enables both power take-off (PTO) and power take-in (PTI) functions. According to Levander, the PTO will supply almost all electric power needed onboard, with the gensets only used when manoeuvring and as back-up. This delivers fuel savings together with lower emissions of up to 15% and is especially beneficial in reducing methane slip by minimising use of the four-stroke auxiliary engines, he says.

Adding batteries takes this a step further. The PTO can be used to charge batteries and stored power can then be used for a range of purposes including blackout reserve, spinning reserve, peak shaving and to power the unit as a PTI for zero-emission propulsion and cargo transfer operations.

Fitted as standard is Kongsberg Maritime’s combined Promas rudder and propeller solution, which is estimated to deliver efficiency improvements between 3% and 6%. The system’s controllable pitch (CP) propeller will also allow easy adoption of auxiliary wind power as it offers more flexibility to work with power sources which deliver large variations of thrust, says Levander, adding that a single-screw configuration has been selected over a twin-screw option because it benefits from lower hydrodynamic resistance and lower investment costs.

For wind power, Kongsberg Maritime, calculates that two optional tilting Norsepower rotor sails – a choice which facilitates port operations and reduce resistance in headwinds – will offer an annual fuel saving of around 8% on a typical North European route.

CII and emissions

The Cobalt Blue concept is estimated to have a CII value 34% below the target line, which should allow shipowners to maintain a CII A-rating for at least 10 years. Taking a holistic view from well to wake, adoption of a novel design with LNG, PTO and wind technologies results in a total decrease in emissions of 36% compared with a conventional MGO-fuelled vessel, of which 12% is attributable to LNG use, 15% PTO operation and 5% wind and remaining improvement to the new ship design, according to Kongsberg Maritime.

Many of these savings are associated with lower fuel use and maintenance costs, leading to an estimated reduction in opex of between 15% and 23%. “Of course, capex is increased owing to machinery costs, but we estimate these are paid off in a period of around five or six years depending on estimated fuel price developments,” concludes Levander.