It’s hard to avoid the resurgence taking place in container shipping at the moment, whether that’s soaring freight rates or a glut of new orders. With that comes a demand for improved cargo stowage and loading solutions from equipment suppliers such as MacGregor. But boxships are just one segment in the global fleet that’s hungry for innovation as the world slowly returns to a post-Covid normality.

“Containers are a great opportunity

where we can offer total solutions when it comes to hatch cover, the lashing bridges and all sorts of lashing gear and so forth,” Magnus Sjöberg, head of MacGregor’s merchant solutions division, tells The Naval Architect. “But we also see good opportunities in the general cargo segment, in terms of how to improve the utilisation of the cargo holds and get more cargo into them. Deep-sea ro-ros, car carriers and PCTCs are picking up as well.”

“Of course every vessel is a kind of prototype and there’s a lot of close development with the owner, consultant and yard on how to improve the cargo hold and get an efficient flow onboard and off of the ship, but also how can you store the different kinds of cargoes, like cars, high-end heavy and project cargo.”

Automated mooring

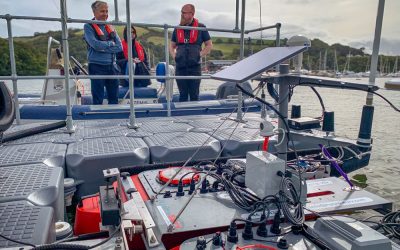

Unsurprisingly, the trends at the forefront of MacGregor’s thinking at the moment are automation and connectivity. It is currently developing a system for monitoring overloads on mooring ropes and chains using automated winches for load sharing, reducing the strain on individual ropes. Sjöberg says the next step will be to further enhance this data from the wind and wave forecasts to enable more effective planning of anchoring and mooring.

The company also is one of the key partners in the Yara Birkeland project, which will eventually see the entry into service of the world’s first autonomous container ship and for which MacGregor is providing the vessel’s automated mooring system. Although Covid has inevitably led to delays on such a complex undertaking, it should begin its operational life very shortly.

Another project that has been hindered, first covered by TNA in November 2018, is MacGregor’s self- discharging bulker crane, a collaboration with operator ESL Shipping. Sjöberg says that it’s still not been possible to set the cranes up in full autonomous mode, although this is expected to take place in the near future. He adds that the same technology is being explored for a couple of R&D projects in the container segment and that several other customers have expressed an interest. MacGregor is working closely with fellow Cargotec subsidiary Kalmar to find synergies in the automation of port operations.

OnWatch Scout

In 2019, MacGregor launched its performance monitoring and predictive maintenance service OnWatch Scout. “It’s an important tool for us and helps the owners, but in the data we gather we see a lot about how the owners and operators use our equipment. Sometimes we see that they overload our equipment to some extent and don’t use it as it was specified,” Sjöberg comments. However, while it has seen a steady uptake among more progressive shipowners, he admits there are plenty not willing to pay the additional cost of connectivity, despite the advantages a proactive approach can bring in terms of reduced downtime.

Needless to say, developing truly integrated equipment solutions depends heavily on the supplier being consulted as soon as possible, preferably in the early design stages. Shipbuilders themselves can sometimes be a recalcitrant element when it comes pushing forward the boundaries, often being content to repeat the same ship designs with minimal variation unless specified by the shipowner. As a company, MacGregor is used to serving yards and owners alike, but Sjöberg says the most efficient solutions invariably mean liaising directly with the end users.

“If you’re not in there and designing efficiently then it’s very difficult to make the changes afterwards. Similarly, when you have an integrated solution inside a ro-ro or ro-pax you have to fight for space with all the other subsystems. So it’s important to work closely with the owner and their consultant even before they start talking to shipyards,” he concludes.