The island nation’s maritime industry is fraught with challenges, but glimmers of hope have emerged

Japan’s maritime sector stands as a testament to the nation’s ingenuity, resilience, and global competitiveness. For over a century, Japanese shipbuilders have been at the forefront of the market, constructing vessels that have sailed the world’s waters with precision and reliability. Yet, beneath this veneer of success lies a landscape fraught with challenges, where economic uncertainties, demographic shifts, and technological disruptions converge to reshape the industry’s trajectory.

At the epicentre of this seismic transformation stands Sumitomo Heavy Industries Marine and Engineering (SHIME), a titan in Japan’s shipbuilding realm for over 125 years. However, in a stunning announcement reverberating across maritime circles, SHIME has recently declared its intent to exit the shipbuilding business — a decision emblematic of Japan’s maritime industry’s struggle to navigate treacherous waters.

The catalysts behind SHIME’s departure are manifold, rooted in a confluence of economic headwinds and demographic realities. The company cites a “deteriorating environment”, marked by soaring material costs and erratic ship prices, as primary drivers behind its exit strategy. This acknowledgment underscores the profound impact of global economic fluctuations on Japan’s industrial landscape, illustrating the fragile interplay between market forces and industrial sustainability.

Compounding these challenges is Japan’s demographic dilemma — a rapidly aging population that threatens to unravel the fabric of the nation’s labour market. According to Statista, a dearth of regular full-time employees plagues major industries, with transportation, construction, and technical research bearing the brunt of the crisis. This demographic imbalance not only strains existing resources but also portends long-term implications for economic growth and sustainability.

In response to these existential threats, SHIME has opted to cease new vessel orders, signalling a strategic pivot away from shipbuilding. Once renowned for producing mid-size Aframax tankers, the company’s decision reflects a sober reckoning with economic realities, tempered by decades of industry expertise and tradition. Despite concerted efforts to weather previous storms, including the fallout from the 2008 financial crash and subsequent global downturns, SHIME finds itself at a crossroads, compelled to chart a new course away from large-scale shipbuilding.

The company can trace its origins back to the establishment of Uraga Senkyo Corporation in 1897 and has a storied history in the shipbuilding sector, with successes like the building of the Seawise Giant in 1979, the longest self-propelled ship ever built.

Rays of light

Amidst these challenges, glimmers of hope emerge as Japan’s maritime industry seeks to reinvent itself for the digital age. Heavy investments in automation and unmanned vessels signal a paradigm shift towards efficiency and sustainability. Yet, while these technological advancements promise to alleviate market gaps and enhance operational efficiency, they also underscore the pressing need to address underlying structural issues, including labour shortages in shipyards.

In tandem with technological innovation, strategic partnerships offer a lifeline for Japan’s maritime sector, particularly in the realm of defence. Increased spending on naval revitalisation, particularly in the Asia-Pacific region, presents opportunities for Japanese shipyards to thrive.

Defence spending amongst ASEAN countries has lately been at an all-time high, largely because of Chinese security threats. However, according to analysis from defence intelligence company Janes, while spending is calculated to be US$12.1 billion higher than in 2023 this still represents a significant slowdown in the rate of spending growth, which spiked to 7.5% year on year in 2023, when Asia-Pacific countries added more than US$41.5 billion to their total defence spend; the most in dollar terms than in any year on Janes’ record.

Collaborative efforts with the United States to repair US Navy vessels in the country, as well as invest in mothballed yards stateside do also present a ray of hope and highlight the potential for cross-border cooperation in bolstering maritime infrastructure and capabilities.

Speaking to financial newspaper Nikkei Asia on a recent visit to Mitsubishi Heavy Industries’ shipyard in Yokohama, accompanied by US Secretary of the Navy Carlos Del Toro, US Ambassador to Japan Rahm Emanuel stated that part of the reason for the visit was to gauge the interest of the Japanese company in investing in opportunities in the US.

Nevertheless, regulatory obstacles, such as the Jones Act, and other US laws prohibiting full-scale overhaul, repair, or maintenance of US-based ships outside the country or Guam, pose significant barriers to collaboration and market access for Japanese shipbuilders.

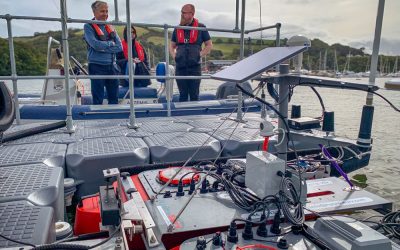

Despite the slowdown on defence spending, continued investments, and cooperation among regional players signal resilience within the maritime landscape. A recently announced partnership between Japan and Australia to focus on enhancing underwater communication technologies and co-develop robotics and autonomous systems (RAS) for undersea warfare, is one such example. The results of the project will be used for the development of unmanned underwater vehicles (UUVs) between Japan and Australia in the future.

As Japan’s maritime industry looks ahead to the future, it confronts a dual imperative: to navigate immediate challenges while laying the groundwork for sustainable growth and resilience. The industry’s ability to adapt, innovate, and forge strategic alliances will determine its trajectory in the years to come.